|

|

Module 3: Ensuring alignment between the OI strategy and the company objectives |

|

|

Adeel Tariq |

|

|

In today’s dynamic environment, attaining growth and specifically, double-digit growth is an important objective of small and large organizations. Several organizations, specifically SMEs, fail to achieve double-digit growth or are unable to sustain it over a long period of time due to their non-systematic approach. An SME can achieve double-digit growth objectives following five-growth disciplines that range from base retention strategy to investing in new lines of business. This module will provide managers of SMEs with knowledge about growth strategies and how they can adopt a systematic approach to deal with them. Moreover, it will also explain to the readers the five strategies for double-digit growth. Furthermore, managers will learn about how they can use SWOT analysis with five growth strategies to effectively explore futuristic opportunities. Lastly, a step-by-step approach is introduced to managers to assist in ensuring the alignment between open innovation strategy and business objectives. |

|

Upon completing this module, you should be able to: |

|

2. Five Disciplines of Growth

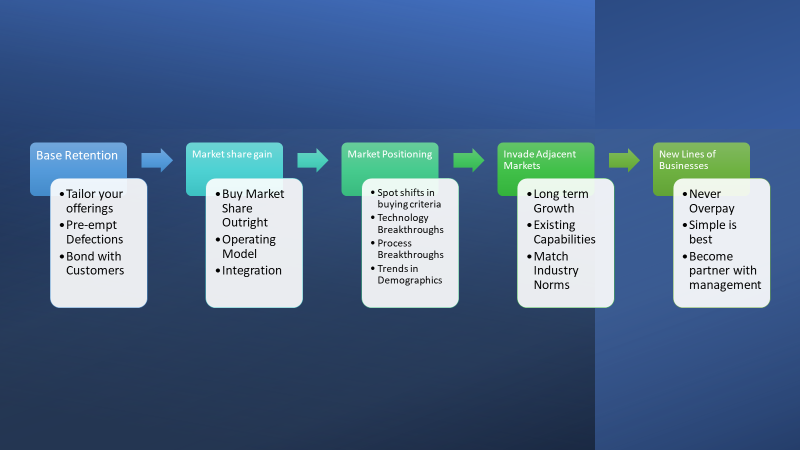

In this section, we have discussed five double-digit growth strategies with guidelines for managers when a specific growth could be beneficial. Particularly, in the recent era, several SMEs have combined these growth disciplines with open innovation approaches to get desired results. However, to decide which growth strategy is more useful for your SME, the manager needs to do a detailed analysis as explained in the next section. Moreover, they can rely on a single or combine artistically one strategy with another to gain desired results.

First Discipline: Base retention strategy

This strategy requires pleasing existing clients by anticipating and meeting their evolving wants and requirements. In addition, businesses must protect their current clientele from defecting to rivals. For instance, when a Swedish Turbo Technology SME, established in 1981 to develop systems that can control exhaust emissions from diesel vehicles, struggled in terms of its sales and retaining current customers, it builds on open innovation approach to address this issue. SMEs partnered with distributors to retain and gain customers in the market and open innovation relieved the company from its struggle and injected a new lease of life.[12] Managers of SMEs can follow this strategy when they want to retain their customers or keep their current customers happy. An SME can keep the customers happy and involved by:

Tailor your offerings: Nowadays, knowledge may be obtained for minimal cost. Many businesses now have enormous troves of client data. The local supermarket likely has your family’s entire shopping history saved right now, deep inside the depths of a data center. Many SMEs have customer data; however, they don’t know how to provide tailored offerings to customers. The frustration of having access to valuable data but not the expertise to effectively use it is a common problem in the corporate world.[13] A company can follow open innovation approach to work with partners to design tailored offerings for its customers.

Pre-empt defections: Imagine if you could predict a customer’s departure. What if you knew why and how to avoid it? Many SMEs can do this. In most cases, they know the client is unhappy with poor service, uncompetitive pricing, or a product that didn’t function as planned, but they don’t tell the part of the business that can fix it, or the supplied information isn’t used. Three things must go right for an SME to foresee and forestall customer departure. It must first accurately forecast the occurrence. Second, it must devise an adequate reaction to the anticipated defection. Finally, the SME must implement the response.13

Bond with customers: Emotions are involved when people and organizations make choices. They may be big or small, good or bad, but they exist. Your company’s connection with consumers affects whether they remain or leave. Emotional and interpersonal relationships may be exploited to counter a value deficiency or a competitor’s offer. Our most frequent emotional interference is with brands; the brand is a company’s promise to the client. Consumers know the brand’s worth and they don’t have to show value; they employ brands to develop an emotional relationship with consumers apart from the product’s practical worth. Brand value is believed in the same way that psychiatrists are actual physicians.13 An SME needs to develop its brands and for this, it can utilize an open innovation approach to learn how to build their bond with their customers.

Second Discipline: Market share gain

The most challenging path to expansion is to win over clients from competing businesses. Once a company has decided to take clients from its rivals, these strategies may be very effective.13 For instance, AgroVegetal was established with a vision to provide healthy fresh foods to the market to improve people’s lives.[14] The company faced a challenging situation in the market, and it must bring its competitors to the table to understand and agree to its terms. This is changing the existing agricultural cooperatives; it was a daunting task as these agricultural cooperatives used to produce and earn royalties for wheat that were produced by public research institutions. No other private company was selling the new variety of wheat and agricultural cooperatives were not interested in buying new wheat varieties as these were better than the public institutions that created wheat. This Spanish SME collaborated with agricultural cooperatives to convert its competitors into collaborators and resultantly gained market share. Using the open innovation approach, the SME was able to build trust among partners and key customers and gain market share along with new business opportunities.[15]

Buy Market Share Outright: There is more than one method to approach the pursuit of market dominance. It is more efficient to buy out the competition and absorb their client base than to attempt to lure them away. Two variations of the approach exist. The roll-up strategy entails swiftly acquiring enterprises in a decentralized industry to become a massive corporation. The second strategy is developing a competitor, absorbing its clients into your own business, and eradicating any remaining traces of the acquired firm to attract new consumers at a low cost. Gaining market share via acquisition makes a lot of sense for companies like First Data Corporation since the cost of acquiring merchant accounts through its bank partnerships is cheaper than the company’s expenses of customer acquisition.[16]

Operating Model: This expansion plan focuses on client acquisition, not on the introduction of novel business processes. In other words, this is not a love match. This strategy aims to absorb, dismantle, and eventually swallow the competition. Customers are kept, the staff is retrained, and assets are redeployed, but the purchasing processes are eliminated and substituted with the acquirers. An effective market share acquisition leaves no trace of the acquired company’s predecessor.

Integration: The ability to swiftly integrate into the market is crucial for the success of any market share acquisition strategy. How Richard Scott led Columbia/HCA through its acquisition integration by adopting a model of efficiency and success. Over two hundred hospitals were bought and incorporated into Columbia/streamlined HCA’s care system throughout his tenure. An effective operational model and careful preparation were the keys to success.

Third Discipline: Market Positioning

Several companies have mastered this strategy by focusing on their market positioning. This strategy requires to spot weak signals in the market, i.e., understanding the changes that are shifting consumers buying criteria. A Lithuania-based electronics SME named Deeper came up with an idea to develop a product that can help in fish finding for shore anglers.[17] They were disappointed with existing market solutions which lead them to diversify to this market and develop a castable sonar device that scans the fish under the water and shows the metrics on the smartphone. Based on their market positioning, they were able to commercialize their product and now it is sold in over fifty countries and the company employs around 100 employees. Moreover, the company is named the second fastest-growing company in central Europe. The company’s success is largely attributed to its open innovation approach to collaborating with several partners from the early stages of product development. The company collaborated with research centers, organized hackathons, and collaborated with the global community through its pro-staff. Thus, the company’s successful market positioning could be largely attributed to understanding the problem with existing solutions, realizing the market opportunity, and using the open innovation approach to address all challenges.17 The takeaway is to get ahead of the competition by leading in the fastest-growing subset of your industry and building on open innovation to deal with challenges. Pay close attention to the following to do this:

Spot shifts in buying criteria: changing consumer value expectations create new market segments. Identifying when and where your customers’ purchase patterns may change can help you to build your company quickly. To capitalize on increasing market segments driven by a shift in customer purchase criteria, you must gamble on the value destination where customers are migrating.[18]

Technology Breakthroughs: To find promising candidates for market positioning, it is essential to first analyze all potentially applicable technological developments from the perspective of your market. The wireless phone sector is a typical example of innovation fueling segment expansion. Landline telephone equipment has hardly risen in the last five years, but wireless has skyrocketed. Few conventional handset makers have been able to transition to the wireless market, despite having the technology. A similar example is, PlatoScience, Plato Science was established in 2015 with disruptive technology, however, the company faced the issue to raise awareness among customers and take feedback on the initial prototype.[19] For their market positioning, the founders decided to follow an open innovation approach, crowdsourcing. With the open innovation approach, the company was able to develop a complete solution based on user experience. They built a huge community of crowds to raise awareness of their solutions and get the required feedback.19

Process Breakthroughs: Process innovation improves consumer value, especially affordability, and convenience. The budget airline sector is one example. Southwest, JetBlue, Ryanair, and EasyJet are four start-up airlines that rushed to exploit a new niche and have exhibited sustained double-digit growth. Process breakthrough done by start-ups and SMEs leads to overall success in terms of double-digit growth.[20]

Trends in Demographics: The challenge is understanding what developments will contribute most to your firm and how to capitalize on them. The aging population, regional transformations, and economic growth are major demographic trends in the U.S. The baby boom has fueled expansion since the 1940s, spanning children’s TV to assisted living. The U.S. Sunbelt movement generated expansion potential for enterprises in the proper location. Developing nations’ economic progress creates chances in China and India. Meanwhile, immigration to the U.S. has boosted service providers to immigrants.20

Fourth Discipline: Invade Adjacent Markets

These adjacent sectors are comparable enough to your previous market to transfer specific skills but distinct sufficient to demand new ones. An example is when a clean Italian technology-based company decided to invade an adjacent emerging market of solar power.[21] For this reason, the company collaborated with public research centers to develop innovative solutions. Company sought funding using open innovation approach and two international players injected the required resources. After a few years, the company spin off its growing solar business and established a new company, today it is the leading company in solar power.21

If you’re thinking about entering a neighboring market, you should first ask yourself these three questions:

Ought you to go into this market? Do considerable prospects for development and profitability exist over the medium to long term?

In a secure market, rivals may try to prevent you from gaining a foothold. As a beginner, you want to know whether you chose well. Candidates with a longer time view sacrifice short-term success to avoid challenges. Entering a thriving nearby market demands timing, and a premature market waste resource. Innovation, process, or customer value transitions may attract new rivals seeking adjacency growth. An example is Sony entered the industry when 16-bit to 32-bit CPUs were utilized. Entrenched competitors, keen to protect their company, delayed adopting new technology or methods, allowing market entry. Transitions between generations don’t guarantee opportunities.

Can you succeed in this industry? Do you stand out from the crowd in significant ways?

Adjacent-market expansion only stands to reason if you have incumbent-beating capabilities. Without them, you won’t win. AT&T tried to integrate local, lengthy, wireless, Internet, and cable services but failed. Armstrong’s thoughts weren’t off. Cable, Broadband, and local phones were neighboring markets. AT&T possessed advantages that may have helped it win, but the people didn’t follow its strategy. It needed top-notch implementation and push-off, which were absent; hence the offer remained unclaimed. Competitive differentiation in a neighboring market should be based on actual benefits, not future goals and romantic potential.[22]

Thirdly, do you think you can measure up to the industry norms?

Given your strengths, you must assess if you have the knowledge and resources to compete with competitors. You don’t need to win every fight but must fulfill marketplace quality standards. These contest standards must be achieved in three main areas: the innovation that supports the sector’s goods or services, your relations with clients, distributors, vendors, and other industry partners, and the business-model layout you’ve selected to generate value for your client’s shareholders, and other stakeholders. For example, after WW11, Grumman Aircraft used its plane-building expertise to make aluminum canoes.22

Fifth Discipline: New lines of business

If the previous four growth disciplines aren’t producing enough growth for your company, this fifth discipline may be precisely what you’re looking for. The fact that you probably won’t have any significant competitive advantages in these far-off areas and won’t have the resources to keep up with the competition makes this strategy dangerous, thanks to open innovation that you don’t need all resources in the modern time and you can collaborate with your partners to be competitive in the market.22

A Danish Mechanical engineering SME, Hannemann, was established in 2007 as a spin-off to supply specialized equipment and handle lifting equipment.[23] In the beginning, SMEs did well in terms of their growth, establishing their manufacturing, and hiring more employees. However, the financial crisis period turns out to be difficult for it and it was pushed to enter a new line of business. Hannemann relied on the open innovation approach and worked with its customers to offer tailored solutions for them. Moreover, Hannemann collaborated with investors, a network of agents, and distributors for the success of its new business.[24]

The following guidelines are essential for the successful operation to enter a new line of business for SMEs:

Never overpay: good investors recognize when to back away from a purchase. They expect a deal but would instead get a bargain.

Simple is best: when it comes to strategy, the more moving parts there are, the higher the risk of failure.

Joint venture with the current management team: in addition to purchasing assets, markets, and companies, an acquirer must also learn new competencies.[25]

Source: Author